“2012 Long-Term Budget Outlook”: It’s Bad

This week the Congressional Budget Office (CBO) released “The 2012 Long-Term Budget Outlook,” its annual report that outlines the nation’s long-term fiscal health. The CBO’s “alternative fiscal scenario” calculates current policies that will likely continue. Key findings are:

- The debt leads to lost income and lower economic productivity.

- The debt will be twice the size of the U.S. economy by 2037.

- Spending on major health care programs will double, to 10 percent of GDP, by 2037.

The outlook for our nation’s fiscal health is predictable, and difficult decisions will be needed to improve it. The President is accountable for failing to take our fiscal health seriously. We are on the brink of leaving for the next generation of Americans a far less secure, strong, and prosperous country than we ourselves have enjoyed.

Debt leads to more than $1 million in lost income for a family of four

A large debt is not an abstract concern – it will affect every American. Under CBO’s most pessimistic scenario, Gross National Product (GNP) per person would be $267,200 lower over 2013-2034. This means that GNP per person for a family of four would be $1,068,800 less than it would be if debt as a percentage of GDP did not increase. Even under CBO’s median scenario, GNP for a family of four would be $266,400 lower from 2013-2037.

Debt crushes our economy

Under CBO’s alternative fiscal scenario, in which debt reaches 200 percent of GDP in 2037, Gross Domestic Product (GDP) will likely be 6.6 percent lower in 2037 than it would if debt as a percentage of GDP did not increase. Under CBO’s most pessimistic economic forecast, GDP would be over 13 percent lower. At over 13 percent lower in 2037, the economy would be over $3.7 trillion smaller than it otherwise would be. At 6.6 percent lower, the economy would be $1.9 trillion smaller than it otherwise would be.

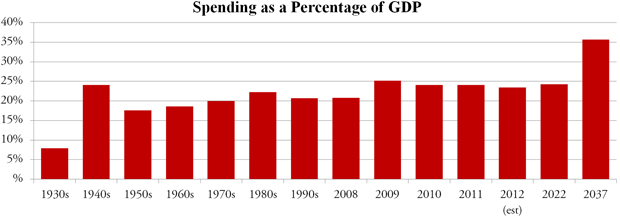

Spending will reach levels not seen since World War II

The report shows that spending is driving the debt. CBO estimates that under its alternative fiscal scenario, total spending in 2037 will reach 35.7 percent of GDP. Non-interest spending alone is 26.1 percent of GDP. The U.S. has not had spending levels like this since World War II.

Publicly held debt skyrockets past European debt levels

CBO projects under the alternative fiscal scenario that publicly held debt increases from 73 percent in 2012 to more than 250 percent in 2043 and thereafter. Public debt skyrockets in the last few years of this scenario, from 199 percent of GDP in 2037 to 250 percent just six years later. Today, European debt levels are well over 80 percent of their GDP.

Delaying difficult decisions makes things worse

The longer it takes to make difficult decisions, the more painful the reforms will be. Maintaining the debt-to-GDP ratio at current levels over the next 25 years would require spending cuts or tax increases totaling 4.8 percent of GDP in 2013. Waiting until 2020 raises the required fiscal adjustment to 6.9 percent of GDP, and waiting until 2025 would mean an adjustment of 9.8 percent of GDP.

Fiscal gap closes by returning to historical spending levels

CBO outlines the level of spending needed to close the fiscal gap, defined as the 25 year increase in debt as a percentage of GDP. The debt would be held steady by holding spending over the next 25 years to an average of 20.5 percent of GDP, which is also the 40-year pre-crisis average of federal spending. The Obama average spending level is more than 24 percent of GDP.

Or by taxing ourselves into oblivion

To maintain current debt-to-GDP ratios over the next 25 years, taxes would have to rise to 24.1 percent of GDP in 2037. This would raise taxes in 2037 by nearly one-third, or $1.7 trillion in inflation-adjusted dollars, compared to our 40-year pre-crisis historical average revenues of 18.2 percent. And the economic harm that such tax hikes would cause would actually result in much less revenue.

Patch for Alternative Minimum Tax (AMT) is critical

Under current law, if Congress does not provide AMT relief to the millions of families that will be hit by it under current law, one out of every two families will be affected by the AMT in 2037.

CBO’s computers cannot estimate economic effects past 2035

Under the alternative fiscal scenario, there is so much debt on the economy that CBO’s computer models cannot reliably estimate macroeconomic effects beyond that date.

Federal health spending will nearly double in the next 25 years

Spending on Medicare, Medicaid, the President’s health care law, and CHIP will go from 5.4 percent of GDP in 2012 to 10.4 percent of GDP in 2037.

Social Security spending will increase by nearly one-quarter

Spending on Social Security will rise from five percent of GDP today to 6.2 percent of GDP in 2037.

Next Article Previous Article