20 Trillion and Counting: The Coming Debt Crisis

- Over the last eight years, the federal government’s debt grew by $9 trillion. It is fast approaching $20 trillion – more than 100 percent of the nation’s GDP.

- Mandatory spending, the driver of future debt, has continued largely untouched.

- If action is not taken soon, growing debt will have severe negative effects on our economy, including reduced military preparedness and less ability to respond to the unexpected.

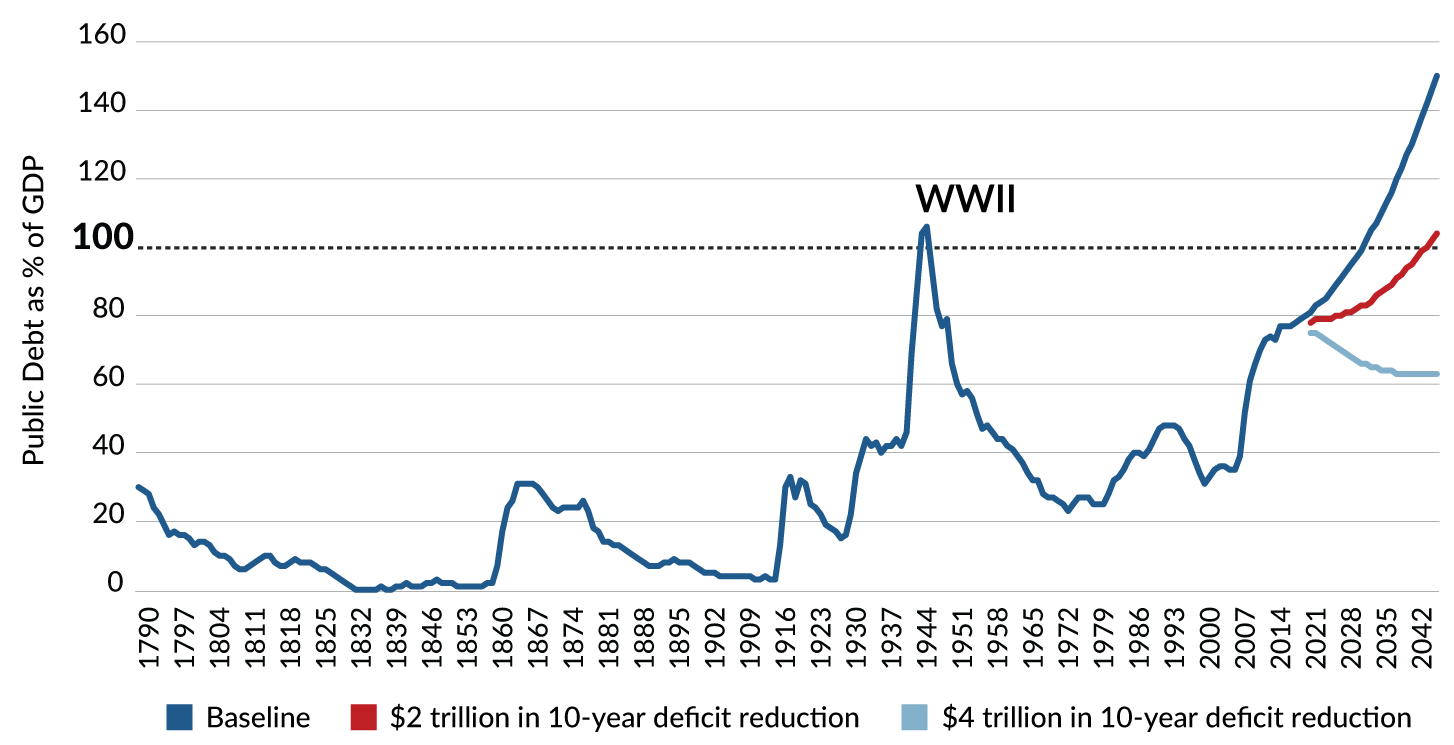

The federal debt limit is currently $19.8 trillion. Because there is a small amount of debt not subject to the limit, the total national debt today is slightly higher. The Congressional Budget Office estimates that Congress will have to raise the debt limit by early to mid-October. As with every other time the debt limit has needed to be raised, this is a reminder that our nation’s fiscal path is unsustainable. There are severe consequences of failing to act on the debt, which is quickly approaching WWII levels – though without the world war.

WWII Level Debt, without the World War

Source: CBO

Consequence #1: Less Funding for National Security

Without action, funding for national security will be squeezed as mandatory spending takes up an increasing share of the economy. CBO estimates that major health care programs – such as Obamacare premium subsidies, Medicaid, CHIP, and Medicare – will rise from 5.5 percent of GDP this year to 9.2 percent in 2047. Net interest – the cost of past deficit spending – will rise from 1.4 percent today to 6.2 percent in 30 years. Social Security, currently the largest single federal program, will increase from 4.9 percent in 2017 to 6.3 percent in 2047.

This leaves “other noninterest spending,” a euphemism for the things that citizens typically think of when they picture federal government activities – including defending the country, building infrastructure, and conducting diplomacy. This category also includes other mandatory programs that are not health or Social Security payments. CBO estimates that spending on all of these activities together will decline from 8.9 percent of GDP in 2017 to 7.6 percent in 2047. National defense makes up 3 percentage points of this number today.

Without reforms, spending in 2047 will exceed 29 percent of GDP. Spending over the past 50 years has averaged about 20 percent of GDP.

Consequence #2: Less Ability to Respond to the Unexpected

One day, our national debt could be so big that it makes it impossible to respond to a pressing need such as a war or natural disaster. Foreigners currently hold 42 percent of the U.S. debt that is publicly held. We owe Russian investors more than $100 billion and Chinese investors more than $1 trillion. By stretching itself so thin, the federal government will have less flexibility to respond to unexpected events and will have to rely on foreign borrowing to do it.

Consequence #3: a fISCAL cRISIS OF oUR oWN mAKING

The future fiscal and financial crisis that could come about due to our growing debt would be entirely the federal government’s fault. The crisis would likely unfold like this: our high debt levels eventually cause investors to demand higher interest rates; if interest rates are substantially higher, the value of existing government bonds will fall by a large amount. Many of the existing bonds are held by institutions like pension funds, insurance companies, and banks. If these institutions start going bankrupt because of the fall in value of Treasury bonds, it could trigger a financial crisis.

Debt Limit Gives Time for Reform

The debt limit is a helpful mechanism to take stock of where the country has been, and where it is going. America paid down our debt as a percentage of GDP after the Revolutionary War, the Civil War, World War I, and the twin crises of the Great Depression and World War II.

Since the “Great Recession” in 2008-2009, both Democrats and Republicans have let mandatory spending drive an increase in debt as a percentage of GDP. Over time, Congress has proven far more inclined to make promises about future benefits than to make the hard decisions needed to stave off the coming fiscal crisis.

The government has set America on a path that, without deviation, will cause the government to lack the financial resources to meet the needs of its citizens. Debt limit debates of the past gave us the Gramm-Rudman-Hollings deficit control law, the 1997 Balanced Budget Act, and the 2011 Budget Control Act. The debt limit debate provides the opportunity to finally address the spending that drives our debt.

Next Article Previous Article